This post initially appeared on Dawn’s personal blog, PracticeBalance.com. Our seeds for stealth wealth were planted in early adulthood, but Dawn’s epiphanies on valueism and the finite resource of money as life energy didn’t come until much later…

Like the “before and after” pictures in a glossy magazine, the way I view money has recently undergone a makeover. Growing up, my family spent money on experiences such as eating out, music concerts, and vacations, but we also loved shopping for stuff. It was an expression of love, success, and celebration. I was obsessed with clothes, and each holiday or change of season was an opportunity to go buy a new outfit. We frequently went to the mall on dreary, rainy days when a pick-me-up was in order. I knew all the style trends and poured over multiple fashion magazines each month, especially ones with those makeover features. It fascinated me how changing just one little thing about a woman’s outward appearance (a different haircut, a more flattering cut of blouse, etc.) could transform her attitudes toward herself and everyone else.

I feel fortunate that my parents designed our lives so that I didn’t have to worry about money. The habits I developed while growing up were not much different than most middle class Americans. That said, my father worked fairly long days and sometimes weekends to ascend the corporate ladder and provide us with more, but I didn’t realize this cost until later. During college, I continued to shop as much as I wanted and not think too hard about money. I got a new car for agreeing to go to the state school (tuition was free due to my academic standing), and I never had to “work” to attend university. Paid summer internships merely provided me with extra spending money. When I separated my finances from my parents with my first “real job” out of college, I continued these patterns and pretty much ignored the mathematics of where my earnings were going. I saved the minimum amount in retirement accounts and spent the rest.

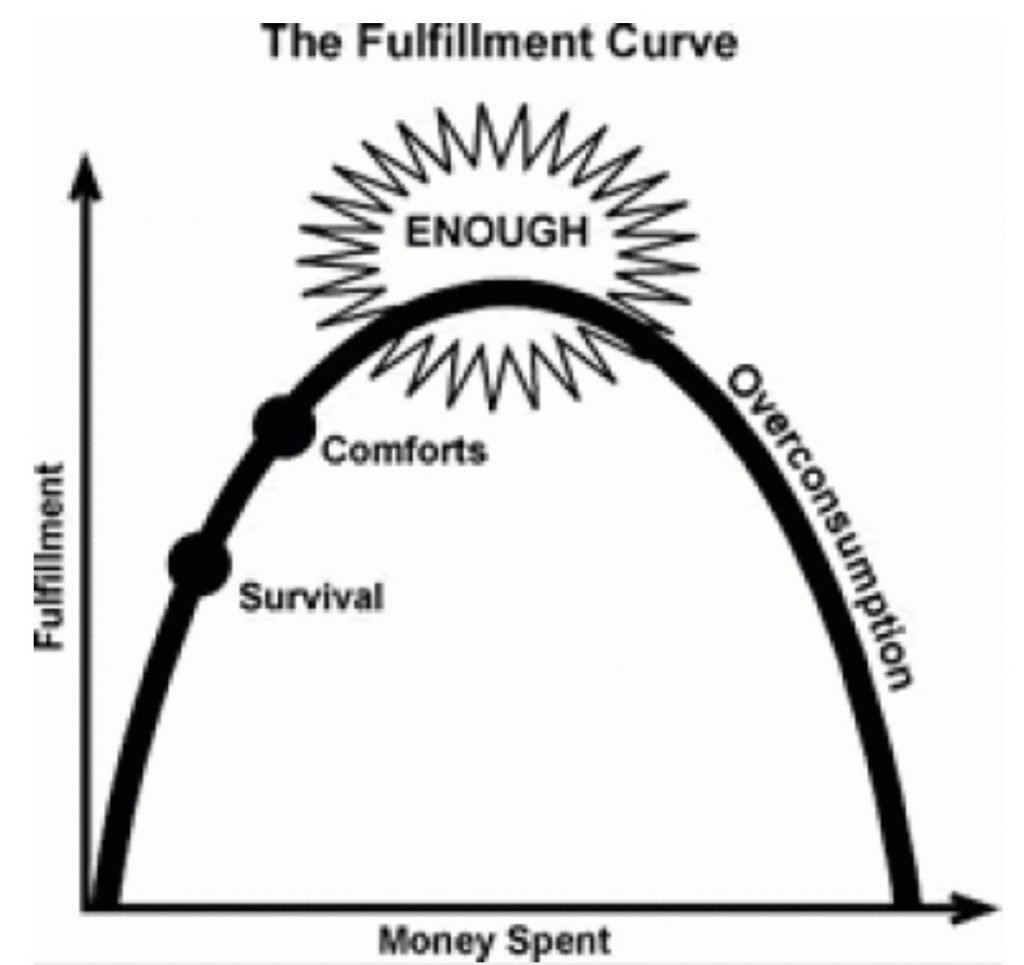

Except, at some point, what I wanted out of life changed, and so did my definition of success. I never knew anything different than the typical career trajectory, work schedule, and retirement path until I started rock climbing. Like other lifestyle sports, climbing envelops your being and puts a different lens on the way you view everything you do. We traveled the country and the world for climbing, and we saw many people living simply with minimal means in order to pursue their passion. Intrigued, we read such tomes as Your Money or Your Life and The Millionaire Next Door, which highlight the idea that money equals life energy. In the former, Vicki Robin outlines something called the Fulfillment Curve, which includes an apex somewhere down the line of spending where “enough” occurs and after which, happiness levels tend to decline. In theory I understood these concepts, but I still refused to view our finances with such a logical lens. As we grew older, we worked to set boundaries for discretionary spending and save more of our income, but not much in my mind had changed.

Until I became a mom. It was as abrupt as looking in the mirror after getting that new haircut or donning that perfectly proportioned blouse. As habits expert Gretchen Rubin discusses in Better Than Before, certain life events can alter a habit pattern virtually overnight (she calls it “the strategy of the lightning bolt”). Think: quitting smoking cold turkey after a lung cancer diagnosis. For me, having my daughter caused an epiphany. All of a sudden, I concretely understood the concept that time = money, and that both are finite resources. All of a sudden, I cared about the possibility of having to work more/longer to keep up certain spending habits.

It wasn’t the typical narrative that you imagine: “I want to provide for my child, give them everything they dream of, fund any education they desire” etc. I wanted to be with her, to spend as much time with her as possible. I had spent so much time and money and physical and mental energy to bring her into this world already, and I was in love. I intensely desired the freedom to work less or not at all if I decided to, the freedom to not outsource everything in our lives in order to keep up with a certain lifestyle and career. In addition, my new responsibilities as a parent were occupying more of my time that had previously been applied to maintaining my closet. I no longer wanted to have 20 pairs of jeans and 50 pairs of shoes to choose from. The decision fatigue was a drain on the energy I wanted to focus on her.

So where are we now? My “money makeover” is really a make-under. I save a very substantial amount of my income in tax-advantaged accounts. We’ve downsized our living space and much of our belongings. My wardrobe, which used to overflow from a walk-in closet, now occupies a normal wall closet with extra space in it allocated for books. I still shop, but I focus on spending my discretionary money on things that enhance my life: things that I actually use instead of pretty skirts that I never wear, things that make my body healthier like gym memberships and yoga classes, and self-care experiences such as massages. When we travel, we usually choose simple, slow-travel options, and we tend to eat homemade foods. Now when I look in the mirror, I see someone who spends more in line with her values and what matters to her most.

Who Is Stealth Wealth Family?

Who Is Stealth Wealth Family?

I love this! You explain so well what you’re thinking. Thanks for writing it and sharing it with the world. I can’t wait to go read about the downsizing now (a theme dear to my heart of late).

Thanks! It took a while to realize that this path had formed. We’re so glad it did.