Financial independence and early retirement are noble goals, and for many people, they’re quite addictive to chase. It’s all about the hustle these days, and with a plethora of FIRE bloggers on the interwebs, there’s myriad voices to provide inspiration in whatever way speaks to you. So should you keep your head down and grind toward your FI goals? Not so fast.

Oftentimes, a big part of being wealthy is being healthy. And being happy. Wealth is like other individually-determined concepts such as stress and balance: they mean what they mean to YOU in your context. Just check out this post by Chris Hogan where he asks others their definition of wealth. If you sacrifice sleep, relationships, or self-care to achieve FI, where will you find yourself on the wealth spectrum?

And what happens once you arrive at that goal? Do you dive exhausted into your recliner chair and flip on the TV? Maybe you hit the road for what is expected to be a never-ending trip, or get rid of all your possessions and move to a remote island… only to burn out down the line. If people don’t have a clear sense of what they’re retiring to, there might be quite a let down in store. Or it could serve as a false summit and not bring happiness at all, but rather more mountains to climb.

This is the paradox living an achievement-oriented life. There needs to be a balance between acceptance of your present situation and the future-focused drive towards something better. We’d like to suggest that you make it a slowly spreading FIRE vs. a 3-alarm blaze.

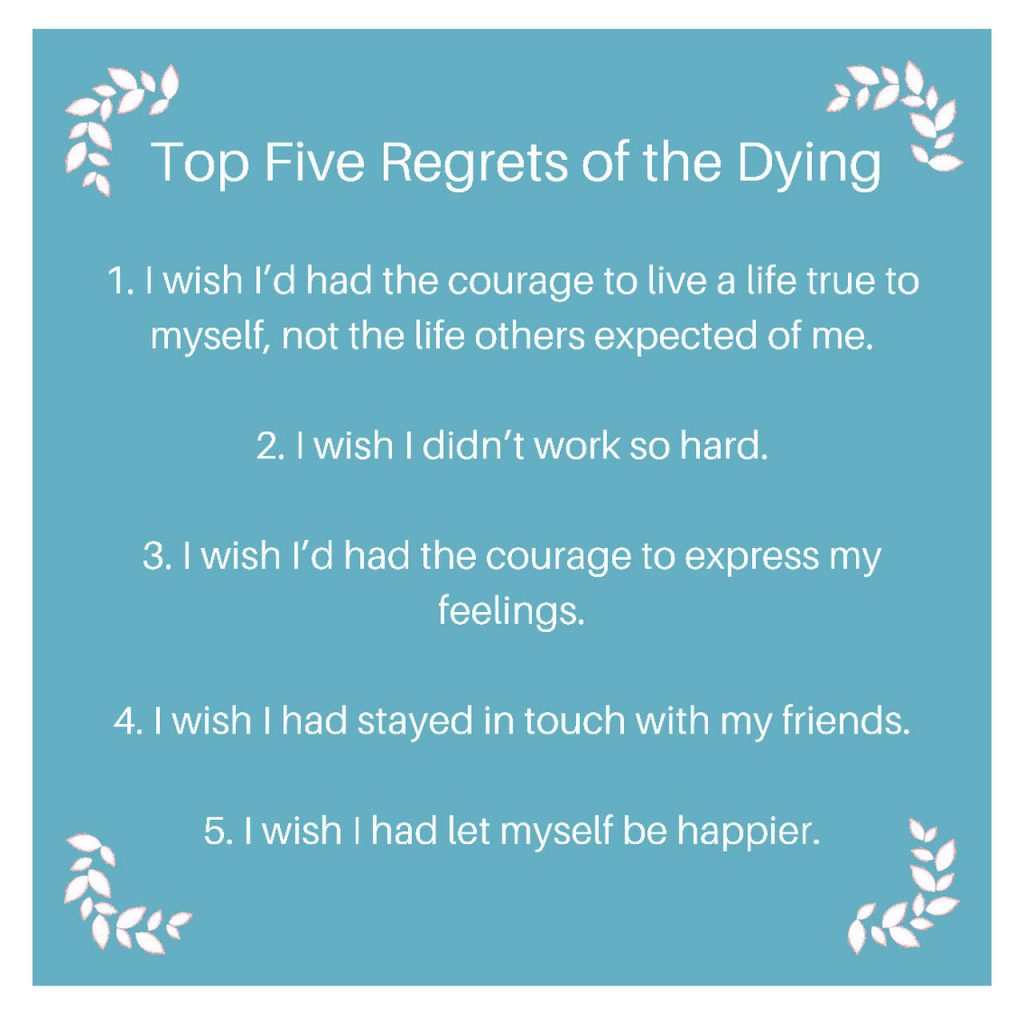

Because nothing in the Top 5 Regrets of the Dying (a report written by a hospice nurse that is now widely-shared wisdom) involves making more money or even being financially secure. Here are the top 5. Pay attention to #2:

We might already be FI, but we’re decidedly not RE Instead, we’ve adopted the glidepath mentality to retirement championed by CrispyDoc. Dawn currently works the 0.5 FTE in a hospital-based practice, which translates to 20-25 hours a week. As a self-employed attorney, Trent works even less – on his terms and within his schedule. And we “work” on our blogs (for free) because we enjoy that process. Even if we phase out of our respective professional jobs in the future, we’ll still be doing some sort of work.

Work provides meaning and connection with people and community. As Wendell Berry said, “The argument here is not against work, it’s against unnecessary work.” So how do you strike the balance between the now and your FIRE future?

- Make sure you know YOUR definitions of FIRE and wealth. Don’t follow someone else’s recipe; use self-introspection to figure out your own FIRE number and your own sustainable savings rate to get there. Contemplate your likes and dislikes; what would you realistically do with increased time and financial freedom?

- Learn how to save and spend flexibly. Take a good hard look at your spending habits and see where the value lies. We’re not for scrimping pennies but instead for putting the most resources towards the most happiness-producing things in your life, and minimizing the rest.

- Focus on experiences vs. things. As part of your scrutinizing, consider that spending money and time on experiences has been shown to bring more happiness than spending on more stuff. And don’t be hesitant to take that vacation.

- Engineer your work life to be more sustainable. Can you go part time right now? Telecommute one day a week? Draw more boundaries on your off time like not answering emails or phone calls at night or on weekends? Cut down on your commute (a major mental and financial drain for many)? Take that stash of FU money you saved through the above and use it as a dose of confidence to optimize your current work situation.

What do you think? How are you balancing the present with the future on your path to FI? Let us know by leaving a comment below!

The Stealth Wealth Family’s Cruise Adventure

The Stealth Wealth Family’s Cruise Adventure

Great post, thanks for the mention!

Our pleasure! Keep up your inspiring content.

Love the way you think and write!

One of the best feelings in the world is batching my reading of an old friend’s thoughts only to feel that once again we pick up precisely where we left off.

You nail the sentiment that where a certain hustler is constantly trying to build side gigs and whip their income into a frenzy (more power to those who enjoy the bustle!), there are a subset of us who focus on pruning away excess branches so our time commitments are gradually made strong and healthy by being the objects of our time and nurturing.

I can’t recall the precise essay, but the author Joan Didion wrote about what happened the day she began saying to obligation that did not directly support her goals. She’s brilliant and bizarre, but she made a compelling case for cutting away what you ought to do and replacing it with what means the most to you.

The beauty of our community of weirdos is that in defining concepts like wealth, enough, and value we support one another in unorthodox choices, and developing a comfort with being the exception allows for exceptional living later.

So happy to be on the glide path alongside you, my friend.

Fondly,

CD

Thanks CD, your comments are as thoughtful and thought-provoking as your blog posts!

We love being contrarians and are happy to have found a like-minded community ?.

The mountains and sky in that picture are pretty amazing!

My wife has been able to cut down to part-time teaching (3 classes) and focus on some other hobbies. She says her quality of teaching has really improved. I was becoming burnt out on healthcare finance a few years ago which initially got me interested in FIRE. I put some boundaries on work (like the email thing you suggested), no more than 40-45 hours, job change, and I have come to really enjoy my job again. I had been contemplating going down to 32 hours per week in 2020 but time will tell! We seem to be in a good spot now, the only thing missing is location independence. Maybe I am getting greedy!

Max

Those are the Wasatch mountains, home to Snowbird, Alta, Brighton, Park City, etc. Definitely awesome.

You’re speaking our language, for sure. Great to hear about your wife’s success with cutting back! Dawn is trying to figure out a situation where she can be location-independent as well. And we encourage your possible decrease to 32 hrs; you won’t regret it!